THE GROWTH OPPORTUNITIES ACT - APRIL 2024

After a long wait, the Growth Opportunities Act was finally announced in the Federal Gazette on March 27, 2024. The Federal Council approved the compromise proposal from the Mediation Committee on the Growth Opportunities Act on March 22, 2024.

The “Act to Strengthen Growth Opportunities, Investments, Innovation, as well as Tax Simplification and Fairness” – known as the “Growth Opportunities Act” – aims to improve companies’ liquidity situations. It also seeks to stimulate companies to make more long-term investments and encourage innovation with entrepreneurial courage. According to the explanatory statement of the draft bill, this is important to accompany economic transformation, strengthen competitiveness, increase growth opportunities, and support Germany as a business location.

Additionally, the tax system will be simplified in key areas, with raised thresholds and allowances designed to reduce bureaucracy, especially for small businesses. Furthermore, as agreed in the coalition contract, the tax law will undergo further modernization.

Here we have listed the main changes in the Income Tax Act for you:

- Expenses for gifts – limit raised from EUR 35 to EUR 50 (§ 4 Abs. 5 S. 1 Nr. 1 S. 2 EStG)

- Temporary reintroduction of declining balance depreciation (AfA) for movable fixed assets (§ 7 Abs. 2 S. 1 EStG) & declining balance depreciation for residential buildings (§ 7 Abs. 5a EStG)

- Special depreciation under § 7g Abs. 5 EStG increased from 20% to 40%

- Increase of the exemption limit for private sales transactions from EUR 600 to EUR 1,000 (§ 23 Abs. 3 S. 5 EStG)

The Growth Opportunities Act has brought additional changes. We are happy to inform you in detail about the relevant amendments.

Feel free to contact us.

E-INVOICING IN GERMANY FROM 2025 – FEDERAL COUNCIL CLEARS THE WAY

1. Legislative Process

After a long wait and a complex legislative process, it’s finally happening: The Federal Council has approved the “Act to Strengthen Growth Opportunities, Investments, Tax Simplifications, and Fairness” (Growth Opportunities Act), which mandates e-invoicing in Germany starting in 2025. This requirement was initially announced in the 2021 coalition contract and made possible by an EU Council implementing decision in summer 2023. Although the law was temporarily blocked in the Federal Council due to disagreements, it has now been approved after the vote was postponed to 2024. Now, only the countersignature and formal issuance of the law remain.

2. Scope of the National E-Invoicing Requirement in Germany from 2025

Starting January 1, 2025, national B2B transactions will be subject to the e-invoicing requirement. This means that domestic entrepreneurs are required to issue e-invoices for taxable services if the invoice recipient is also located domestically. This requirement applies to entrepreneurs with headquarters, management, residence, or habitual residence in Germany, as well as domestic VAT-registered establishments. Exemptions from this requirement apply only to small amount invoices and transportation ticket invoices.

3. Definition of an E-Invoice

The e-invoice is redefined and must comply with the standards of Directive 2014/55/EU, or an alternative format agreed upon between the invoice issuer and recipient that allows for correct and complete extraction of the necessary information. Invoices that do not meet these requirements are considered “other invoices.”

4. Transition Regulations

The e-invoicing requirement takes effect on January 1, 2025, with transition regulations only applicable to the invoice issuer. Invoice recipients will be fully required to accept e-invoices starting in 2025. Various transition periods apply for invoice issuers, with most being affected by the e-invoicing requirement only from 2027. However, companies must adapt their ERP systems for e-invoice receipt as early as 2025.

The introduction of the e-invoicing requirement marks a significant step towards digitalization and efficiency in business transactions and requires corresponding adjustments from companies.

KLAIBER AWARDED AS "EXCELLENT EMPLOYER 2024"

KLAIBER AWARDED IN INDUSTRY COMPARISON.

At KLAIBER, exceptional employee development is our top priority. A culture of appreciation, an outstanding work environment, and fair compensation – excellence is at the core of what we do. We are proud of this recognition and how valued and comfortable our team feels with us.

KLAIBER PRACTICAL TIP: NEW TAX CHALLENGES IN DEALING WITH CRYPTO ASSETS

We are currently receiving an increasing number of notifications and inquiries from tax authorities regarding income from crypto assets abroad. Therefore, we would like to inform you about the latest developments in the area of automatic information exchange (AIA) concerning crypto transactions.

On October 17, 2023, the EU Council officially adopted the directive amending the EU rules on administrative cooperation in taxation (DAC 8). This development shifts the focus of tax authorities to crypto assets and high-net-worth individuals (see the EU Council press release dated October 17, 2023).

The updates include the addition of new types of assets and income, particularly crypto assets. Tax authorities will now be required to automatically exchange information provided by reporting crypto service providers. The decentralized nature of crypto assets has so far made it difficult for member states’ tax authorities to ensure compliance with tax regulations. The reporting obligation under DAC 8 will begin in 2026, with the first reports due by January 31, 2027. Other innovative financial products, such as e-money, e-money tokens, and central bank digital currencies, are also covered.

Additionally, the existing automatic information exchange is being expanded to include cross-border tax rulings for high-net-worth individuals and information on dividends from companies whose shares are not held in a bank account.

EU member states are required to implement the key provisions into national law by December 31, 2025. The regulations are expected to take effect on January 1, 2026.

We are happy to provide individual advice.

Feel free to contact us for further information.

KLAIBER NEW YEAR’S CELEBRATION 2024

It has become a tradition for the KLAIBER team to celebrate the start of the new year together instead of Christmas.

After a short walk through snowy Albstadt, we returned to the festive Villa Haux. With mulled wine and pizza, the cold quickly melted away, and after some encouraging words from management, the team enjoyed games, fun with VR glasses, and a lively atmosphere. The evening ended on a high note, kicking off the new year with positivity.

KLAIBER AT THE APPRENTICE FAIR "STARTKLAR" IN EBINGEN – JANUARY 2024

On January 11 and 12, 2024, KLAIBER was represented with a stand at the “STARTKLAR” apprentice fair.

We look back on two successful days at the first apprentice fair in Albstadt-Ebingen and thank all visitors for stopping by our booth.

A FRACTIONAL OWNERSHIP ENTITY DOES NOT PROVIDE SERVICES FOR CONSIDERATION AS AN ENTREPRENEUR

WE EXAMINE THE FOLLOWING CASE:

Several individuals jointly purchase a combine harvester, with the invoice issued to the “partnership.” This raises questions regarding the VAT treatment of this joint purchase and the free provision of the harvester among the co-owners. The following aspects must be considered in such a case.

Entrepreneurial Status:

The fractional ownership entity is not considered a VAT-registered entrepreneur. The assessment of entrepreneurial status is conducted at the individual co-owner level.

Service Usage:

The individual co-owners are regarded as service recipients. A representative appointed by the partnership holds the original invoice, while the other co-owners receive copies. This raises questions about how the service relationship between the partnership and the co-owners is structured.

Input Tax Deduction:

The input tax deduction is only available to the co-owner who is an entrepreneur and uses the purchased service for their business. The invoice can be issued to the partnership, provided it includes the full name and address. The partnership’s records must include the names of the other co-owners, who can claim their input tax deduction in their personal VAT returns.

Important Note:

This regulation applies to all fractional ownership entities that provide items to co-owners free of charge. It is important to note that the option under Section 9 of the German VAT Act (UStG) must be reviewed individually for each rental transaction with each co-owner.

In conclusion, the VAT treatment of jointly acquired assets requires a thorough assessment of entrepreneurial status at the individual co-owner level. Proper allocation of input tax deductions and compliance with legal regulations are essential for handling such transactions correctly. The Federal Fiscal Court (BFH) rulings from November 22, 2018, and May 7, 2020, provide crucial guidance in this matter.

MANAGEMENT REJUVENATION – THE NEW KLAIBER MANAGEMENT TEAM

As of May 4, 2023, Alexander Holzhofer has taken on the role of Managing Director of Klaiber GmbH Steuerberatungsgesellschaft, joining Gerd Klaiber and Sinja Pfeifer in leading this Albstadt-based company with both national and international reach. This appointment continues KLAIBER’s strategic focus on the future and rejuvenation at the management level, which began two years ago.

The 33-year-old tax advisor and specialist in international tax law joined the mid-sized Swabian firm in 2018 and assumed the role of team leader and proxy holder in 2020. His promotion to Managing Director marks a natural progression in his professional and personal development.

“I’m very excited about this new role and the associated challenges. I am confident that we will continue KLAIBER’s unique success story sustainably, future-oriented, and aligned with the digital, international era,” said Alexander Holzhofer about his appointment.

He will oversee operations in corporate succession, restructuring, and digitization. Sinja Pfeifer praised her new management colleague, stating, “Alex knows the company inside out and has significantly contributed to KLAIBER’s successful development. With his expertise, he will provide crucial impetus for the company’s future. I look forward to continuing our collaboration and wish him great success in his new role.”

Klaiber GmbH Steuerberatungsgesellschaft, along with other entities in the KLAIBER Group (Klaiber Wirtschaftsprüfungsgesellschaft and Klaiberconsulting SL), is dedicated to acting as a “bridge builder.” Founder Gerd Klaiber explains, “We aim to provide our clients with the best possible tax and business advice both locally and across borders. With our strong international network, we can guide our clients securely across borders while addressing not only tax issues but also economic, legal, and cultural aspects. With our auditing firm, we support both locally rooted and multinational companies, building bridges from national requirements to those arising from globalization.”

On this foundation, the KLAIBER Group is continuing its organic growth this fiscal year, achieving over 20% growth. As an agile service provider, the Group remains a sustainable partner for families and medium-sized enterprises.

PHOTOVOLTAIC SYSTEMS MADE SIMPLE – JUNE 2023

#PhotovoltaicSystems: The guidelines are constantly changing, and the information provided is often overly complicated and hard to understand. UNTIL NOW!

The tax administration has released an excellent guide that we are happy to share with you.

Follow the link below for a clear and straightforward overview of the most important questions and answers regarding photovoltaic systems:

Your Photovoltaic System – Less Taxes, Less Bureaucracy (bundesfinanzministerium.de).

PHOTOVOLTAIC SYSTEMS MADE SIMPLE – JUNE 2023

As of June 30, 2023, new reporting obligations apply to foreign entities owning domestic real estate. This measure is a response to the increased enforcement of economic sanctions as a foreign policy tool. The Sanctions Enforcement Act II, passed on December 19, 2022, introduces rules to improve the allocation of assets.

One key provision links real estate ownership registered in the land register with the transparency register to enhance transparency in the real estate sector. Existing properties owned by foreign entities must now be reported to the transparency register. Previously, reporting obligations applied only to acquisitions of domestic real estate or shares in property-holding companies.

Since December 28, 2022, the reporting requirement extends not only to new acquisitions of properties or shares but also to existing real estate. Exceptions may apply if there is already a reporting obligation to the transparency register of another EU member state.

Foreign companies subject to reporting requirements have until June 30, 2023, to report “direct” property acquisitions before January 1, 2020, and shareholdings of at least 90% in German companies with real estate before August 1, 2021.

Multinational companies currently face significant challenges in preparing for the implementation of global minimum taxation. Consolidating and harmonizing data across cross-border corporate structures requires considerable effort, as no comparable information-gathering process has existed before. Beyond material tax law developments, businesses are increasingly facing procedural obligations, particularly in transparency requirements. These are continually being tightened, not only in tax law but also in other areas, such as disclosure requirements for digital platforms (DAC7), reporting obligations for crypto assets and e-money (DAC8), supply chain transparency (LkSG), or the introduction of transparency registers.

Non-compliance with reporting obligations can result in substantial fines. It is therefore advisable to pay close attention to these new requirements and ensure timely compliance. The multitude of “transparency obligations in international tax law” now presents a significant challenge for taxpayers due to the necessary reporting, ad-hoc cooperation, and disclosure requirements. The legal and tax experts at KLAIBER Group are here to guide and advise you effectively.

ANNUAL TAX ACT 2022

The Annual Tax Act (JStG) 2022 was published in the Federal Gazette on December 20, 2022 (BGBl 2022 I S. 2294). It has undergone extensive changes compared to the draft proposed by the government, incorporating numerous new regulations.

The following points finally provide legal clarity and certainty through statutory clarifications:

- Entrepreneurial Status (§ 2 Para. 1 Sentence 1 UStG)

With its ruling of November 22, 2018 – V R 65/17 (NWB QAAAH-06916), the Federal Fiscal Court (BFH) deviated from previous jurisprudence and the administrative stance, ruling that a fractional ownership entity cannot be considered an entrepreneur.

Section 2 Para. 1 Sentence 1 UStG has been amended to clarify that entrepreneurial status under VAT law exists regardless of the legal capacity of the acting entity. Entrepreneurs can therefore also include non-incorporated partnerships that independently conduct commercial or professional activities and act as entrepreneurs in economic transactions. This applies, for example, to fractional ownership entities.

- Correct EC Sales List and Tax Exemptions for Intra-Community Supplies (§ 4 No. 1 Letter b UStG)

By repealing § 4 No. 1 Letter b Sentence 2 UStG, it has been clarified that the conditions for VAT exemption for intra-community supplies are independent of the deadline specified in § 18a Para. 10 UStG.

a) Tax Exemptions for Intra-Community Supplies (§ 4 No. 1 Letter b UStG)

Under § 4 No. 1 Letter b Sentence 1 UStG, intra-community supplies (§ 6a UStG) are VAT-exempt if the entrepreneur has fulfilled their obligation to submit an EC sales list (§ 18a UStG) and this list has been correctly and completely submitted concerning the respective supply.

Previously, § 4 No. 1 Letter b Sentence 2 UStG required that corrections to an incorrect or incomplete EC sales list under § 18a Para. 10 UStG be submitted within a month. With the Annual Tax Act 2022, this sentence has been repealed, ensuring that VAT exemption conditions are not bound to this deadline. This deadline remains relevant only for conducting proper intra-community control procedures or potential penalty proceedings (§ 26a Para. 2 No. 5 UStG).

The obligation to submit a correct and complete EC sales list as a prerequisite for VAT exemption continues beyond the deadline specified in § 18a Para. 10 UStG. If the entrepreneur submits a corrected or initial EC sales list for the relevant period within the assessment period, the VAT exemption can be reinstated, provided all other conditions are met.

For further questions, the KLAIBER team is happy to assist you.

VAT TAXATION OF CONSTRUCTION SERVICES FROM 2023

Attached is the current information sheet on “VAT Taxation in the Construction Industry” dated January 27, 2023.

You can find it here: 2023-01-27-merkblatt-umsatzbesteuerung-in-der-bauwirtschaft-USt-M-2.pdf

It contains the key principles of VAT taxation for construction services, particularly for construction companies executing transactions where the recipient is not liable for VAT under Section 13b Para. 2 UStG.

If you have any questions regarding VAT taxation, please don’t hesitate to contact us.

STATISTICAL REPORTING IN FOREIGN TRADE

In accordance with Sections 67 and 68 of the Foreign Trade Ordinance (AWV), all companies, public authorities, and individuals domiciled in Germany are generally required to electronically report every cross-border capital flow to the Deutsche Bundesbank on a monthly basis.

Under Section 19 Para. 3 No. 1 lit. b of the Foreign Trade Act (AWG) in conjunction with Section 81 Para. 2 No. 19 AWV, failure to submit, incorrect, incomplete, or late submissions of reports under Section 67 Para. 1, also in conjunction with Section 68 Para. 1 AWV, constitutes an administrative offense. This offense can result in fines of up to €30,000 under Section 19 Para. 6 AWG.

Payment Reporting (Z4 Reporting):

Reportable transactions include payments exceeding €12,500 per month or equivalent value, made by domestic companies, public authorities, or individuals to foreign companies, or vice versa. These include transfers, direct debits, checks, bills of exchange, cash payments, as well as offsets and netting. Contributions of assets and rights into companies, branches, or permanent establishments are also reportable.

Payments related to the import and export of goods, as well as loans with an initial term or notice period of less than 12 months, are exempt from reporting obligations.

Balance Reporting on Foreign Claims and Liabilities (Z5-, Z5a-, Z5b Reporting):

German companies (excluding Monetary Financial Institutions, Investment Corporations, and Capital Management Companies for their special funds) must report all claims and liabilities against foreign entities monthly, provided these exceed €5 million or equivalent value.

Balance Reporting on Cross-Border Corporate Investments (K3- and K4 Reporting):

German companies, public authorities, and individuals are required to annually report cross-border corporate investments if the capital or voting rights share is at least 10% and the balance sheet total exceeds €3 million or equivalent value.

We are happy to review your obligations with you in advance, determine whether you are required to submit reports to the Deutsche Bundesbank, and assist in preparing and submitting them.

INCREASE IN INHERITANCE AND GIFT TAX ON REAL ESTATE AT THE TURN OF 2022/2023

KLAIBER Practical Tip

Significant Increase in Inheritance and Gift Tax on Real Estate at the Turn of 2022/2023:

The draft Annual Tax Act 2022 proposes a significant increase in inheritance and gift tax for many real estate properties. While the draft has primarily been highlighted in the media for introducing certain tax relief measures, the changes to the Valuation Act present some surprises, provided the Federal Council approves the Annual Tax Act 2022 in December.

Preliminary sample calculations estimate a 20 to 30 percent increase in taxable real estate values for individual houses and condominiums. For (partially) commercial properties, changes in valuation methods could even result in a doubling of values. These adjustments aim to align valuation procedures with current market conditions.

The new rules on tax valuation affect real estate assessed using the income or cost approach. The cost approach applies to residential and partial ownership properties, as well as single and two-family homes, while the income approach is used for rental and commercial properties.

Going forward, regional differences in construction costs will be accounted for using a regional factor, potentially leading to significantly higher valuations, especially in major cities. For many building types, the statutory total useful life will be extended from 70 to 80 years, which will also increase property values. Similar effects are expected due to lower fixed amounts for operating costs, which are based on either the property’s area or the number of units.

Furthermore, statutory capitalization rates for all property types will be reduced, which will increase the capitalization factor and, in turn, the tax value of the property.

If the Federal Council approves the Annual Tax Act 2022 in December, these changes will generally lead to higher property valuations. However, it is still possible to prove a lower value through an expert appraisal. Given these developments, it may be worth considering advancing planned property transfers or at least reviewing the potential impact of the new rules on a case-by-case basis.

KLAIBER EXPANDS YOUNG LEADERSHIP TEAM

THE SPREAD OF E-INVOICING IN THE EU

Below is an overview of current and upcoming e-invoicing requirements in select EU countries:

Belgium: E-invoicing is mandatory nationwide only for amounts exceeding €135,000. Public authorities in the Flemish region have not accepted paper invoices since 2018, a rule extended to the Brussels region in November 2020. Invoices can be submitted via the MERCURIUS portal.

France: France has announced mandatory e-invoicing for businesses, with deadlines varying by company size. Large companies must comply by July 2024, while smaller companies have until January 2026. Submissions are centralized via the tax authority’s Chorus Pro server or decentralized through approved IT providers.

Italy: E-invoicing has been mandatory for public authorities since 2015 and for B2B and B2C transactions since 2019. Invoices are submitted via the centralized Sistema di Interscambio. From mid-2022, medium-sized businesses with turnover above €25,000 were also included. Smaller businesses will follow from 2024.

Netherlands: E-invoicing to central government authorities has been mandatory since 2017, with the obligation extending to all public authorities in 2019. The standard format is UBL-OHNL.

Austria: E-invoicing for public authorities has been mandatory since 2014, with submissions via e-rechnung.gv.at in ebInterface and PEPPOL-UBL formats.

Poland: Since January 2022, Polish companies can submit e-invoices via the state’s KSeF portal. Mandatory e-invoicing will apply to companies based in Poland starting in 2024.

Portugal: E-invoicing has been required for public authorities since December 2020 and for small and medium enterprises since December 2021.

Romania: Public authorities must accept e-invoices, but suppliers are not obligated to send them. Since July 2022, specific sectors vulnerable to tax evasion, such as construction, alcohol, and produce, must issue e-invoices using the RO_CIUS standard.

Slovakia: E-invoicing for public authorities via the IS EFA portal has been mandatory since 2022. Starting in 2024, after a test phase, all taxpayers providing B2B and B2C services in Slovakia must implement an e-invoicing system.

Spain: E-invoicing has been mandatory for public authorities since 2015 using the FacturaE format. From 2024, companies with annual turnover exceeding €8 million will also be required to issue e-invoices.

Hungary: While e-invoicing is not mandatory, all B2B and B2C invoices must be electronically submitted to the tax office (NAV) within one day.

If your business operates a VAT establishment in the EU, adapting to various e-invoicing systems will soon become unavoidable. We recommend closely monitoring developments in e-invoicing to respond promptly with necessary adjustments.

HOHENZOLLERN EQUESTRIAN TOURNAMENT – OCTOBER 2022

KLAIBER COMPANY OUTING 2022

Under beautiful sunshine and with lots of fun, the KLAIBER company outing took place in Überlingen at the picturesque Lake Constance.

Activities included e-bike rides, sailing, and some colleagues enjoying the late summer weather on Mainau Island.

In the afternoon, we explored Überlingen through historical and botanical city tours.

After a delicious dinner at the Überlingen lakeside promenade, we rounded off the successful day with a cheerful gathering at the Galgenhölzle Überlingen.

Special thanks to Mr. Michael Jeckel from Galgenhölzle for hosting us!

KLAIBER PRACTICAL TIP: WITHHOLDING TAX

KLAIBER WEDDINGS IN JULY 2022

The KLAIBER family had the pleasure of celebrating three weddings in July!

We extend our heartfelt congratulations to our colleagues Madeleine Dapp, Alexander Holzhofer, and Carmen Halder on their marriages and wish the newlyweds all the very best for their future together.

"THE END CROWNS THE WORK" – SUCCESSFUL COMPLETION OF TRAINING – JULY 2022

HERZLICHEN GLÜCKWUNSCH

CONGRATULATIONS!

“The end crowns the work.”

– William Shakespeare

…and you have succeeded in completing your journey with excellence.

We warmly congratulate Kerstin Fritz on becoming a Certified Office Manager and Gabriel Virtaci on qualifying as a Tax Clerk. We are so proud of you!

A special congratulations to Gabriel Virtaci, who delivered an impressive speech during the certificate ceremony of the Chamber of Tax Advisors in front of 500 attendees—what a remarkable achievement!

CONGRATULATIONS ON BECOMING A CERTIFIED ACCOUNTANT – JULY 2022

We warmly congratulate our colleague Leonie Stephan on passing her certification exam.

With her successfully completed advanced training as a Certified Accountant, Ms. Stephan has expanded her expertise and will continue to support our clients at the highest professional level.

We are proud of you, Leonie—congratulations!

KLAIBER BBQ FESTIVAL – MAY 2022

FAMILY DAY WITH A FOOD TRUCK

Under the theme “Fun and games for the whole family,” our KLAIBER BBQ Festival took place in the garden of Villa Haux. Blessed with beautiful weather, the entire KLAIBER family enjoyed a wonderful day filled with delicious burgers and sausages from the Grillgut Food Truck by Bogenschütz, refreshing drinks, and face painting for the little ones.

A special highlight was the tour of the Villa, where the kids could step into the magical world of breathtaking princesses and noble knights.

We extend a heartfelt thank you to all colleagues, family members, children, companions, and helpers who made this event so memorable. We’re already looking forward to our next KLAIBER event!

Would you like to become part of the KLAIBER family? Apply now! Check out our current job openings at www.kl-klaiber.de/karriere/stellenangebote/.

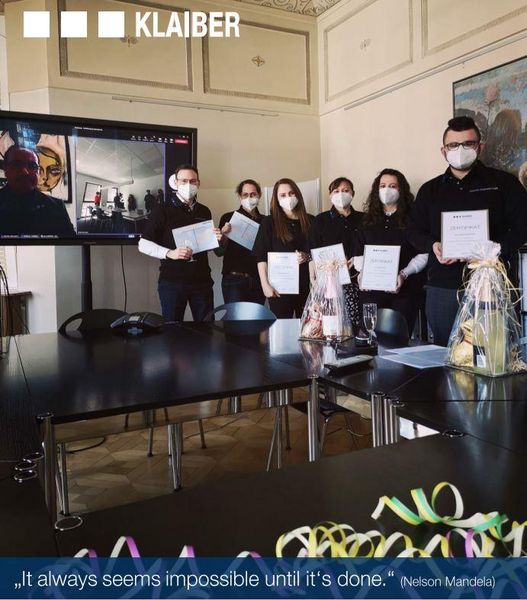

KLAIBER CELEBRATES SUCCESS – INTERNAL TRAINING FBI – MARCH 2022

Congratulations!

KLAIBER celebrates success!

Today, we proudly congratulate our colleagues Kristina Nosova, Eva Henes, Jana Senfle, and Daniel Petretschek on completing their internal training as Specialist Assistants in International Tax Law.

Since May 2021, our trainers Sinja Pfeifer and Alexander Holzhofer have guided participants through regular study modules and practical case studies in international tax law. The knowledge gained was reinforced through assignments and finally demonstrated in the final exam in mid-March 2022.

We are thrilled and proud to welcome four newly qualified specialists to our “International Team.”

For over 25 years, KLAIBER has delivered exceptional consulting quality to its clients. To meet the growing demands, especially in international matters, we place great importance on the continuous development of our employees.

KLAIBER ESTABLISHES KLAIBERCONSULTING S.L. IN MALLORCA – PRESS RELEASE MARCH 2022

The Klaiber GmbH Tax Consultancy expands its reach by founding KLAIBERCONSULTING S.L. in Mallorca.

As of September 1, 2021, KLAIBER has been collaborating with its newly established subsidiary, KLAIBERCONSULTING S.L., to offer services directly on Mallorca.

With Daniel Anwander, Tax Consultant and Specialist in International Tax Law, as Managing Director, KLAIBERCONSULTING brings an extensive network across Spain to assist with private or commercial investment inquiries on the Iberian Peninsula and Spain’s islands.

From investment and financing advice to tax consultation on purchases, transfers, and successions, the focus also lies on the legal implications of relocation.

“To avoid double or multiple taxation, tax declarations in Spain can be seamlessly handled in close coordination with local partners, ensuring clear communication and efficient processes,” says Daniel Anwander.

New Office Space in Southwest Mallorca

In the modern and prestigious office complex “The Circle” (Carrer Illes Canàries 18, Polígono Industrial Son Bugadelles, 07183 Santa Ponsa – Calvià; see photo), KLAIBERCONSULTING S.L. is now represented in Southwest Mallorca, in addition to Palma. The Circle unites real estate industry professionals under one roof in Mallorca’s first innovative office concept. This sector focus fosters synergistic and highly efficient collaboration.

KLAIBER Workwide – Make the World Your Workplace!

This new international branch also opens opportunities for KLAIBER employees. With the growing demand for remote work, KLAIBER now offers the option to work remotely from almost any EU country for a defined period, providing employees with enhanced flexibility to suit modern work preferences.

CONGRATULATIONS ON YOUR 10-YEAR ANNIVERSARY – JANUARY 2022

“Passion is the starting point of every success.”

We warmly congratulate our colleague Ludmila Dik on her 10-year work anniversary at KLAIBER.

Thank you for your tireless dedication! Your approachable and kind nature is a true asset to both your colleagues and clients.

We look forward to many more successful years together!